Help to Buy ISA

| Help to Buy ISAs are now closed to new applicants |

The value of investments and the income they produce can fall as well as rise. You may get back less than you invested.

Tax treatment varies according to individual circumstances and is subject to change.

To help first time buyers get on to the housing ladder, the government introduced a new form of ISA from Autumn 2015 called the Help to Buy ISA. It has all the tax advantages of a cash ISA but is also topped up by the government by up to an additional £3,000. It is designed to help first time buyers save enough to put down a deposit for their first home.

The Help to Buy ISA will be available through banks and building societies. First time buyers that save through a Help to Buy ISA receive a government bonus to help encourage them to save.

How does it work?

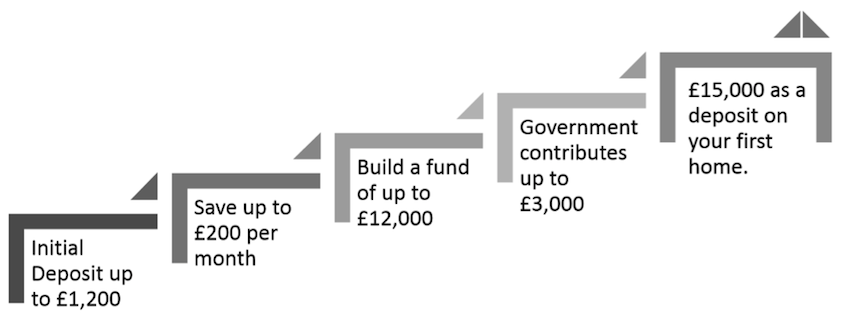

The saver opens up a Help to Buy ISA (H2BISA) at a bank or building society. You will need to be over 16, have your National Insurance No. and be a first time buyer. You can only open one H2BISA and the saver can save a maximum of £200 per month into the H2BISA. The government will increase this by 25% when the saver buys their first house.

You can deposit a lump sum of up to £1,200 into the account as you open the account. The maximum amount that can be saved under the H2BISA is £12,000. The government will top this up by 25% of the amount saved, to a maximum of £3,000 to bring the total saved to £15,000.

The bonus is paid when the saver commits to buying a property as their main residence (not buy to let). The bonus is subject to a minimum claim of £400 (requiring a minimum of £1,600 of savings).

The amount saved can help pay the deposit on a house up to the value of £250k outside London and £450k in London.

It is intended that H2BISA accounts will be limited to one per person not one per household, so a couple could put two H2BISAs together to buy a home. In theory a number of people could club together to buy a house although there may be some restrictions put on this when they are released in the Autumn 2015.

Once an account is opened there is no limit on how long a person can save into a H2BISA and no time limit on when they can use their government bonus.

For further information see https://www.gov.uk/government/publications/help-to-buy-isa

Contains public sector information licensed under the Open Government Licence v3.0.

Also See

tFinancial Advice... pure and simple

The Ethical Partnership Ltd provides financial advice and planning, in plain English, to people who want to ensure they make the right financial decisions at the right times and at the right cost. It's simple!